How to optimize your mortgage direct mail marketing strategy

Each direct mail campaign is a unique field for experimentation — it’s always best to test different formats and analyze results to learn what fits you best. However, several universal tips will open valuable brand-building and lead-generating opportunities.

Set your goals

The final goal of any marketing campaign is closing more sales. But you need to specify the tasks that will lead you to that big goal for each campaign. For example, if your business is new to the area, the task for the first campaign can be introducing your services to potential customers and making a great first impression. Forcing sales without further ado at this stage can make you look unpleasantly pushy.

Next task can be becoming top-of-mind when it comes to mortgages. You may gather professional events for that, so the goal of your direct mail campaign will be to get more people to visit them. Next, you can start collecting leads.

You can come up with different on-the-fly tasks like informing about new mortgage regulations and programs or presenting new properties. Keep your goal in mind to make your message clear.

Define your target audience

The more relevant your message to the exact recipient, the higher your chances to get a response. The key to success is sending a perfect offer to every member of your target audience.

There are different techniques to narrow down your target audience. The general approach is imagining you want to buy a certain house and trying to figure out what interests you most. Having a clear vision of your target audience will also help to create perfect mailing lists. It can also help to choose the right time for a contact.

For example, families with babies may have less time and focus than others: they may benefit from your visit much more than from a huge catalog of programs. It might be a good idea to offer them one and underline that you understand how busy and tired they are now and that you want to help. Families having a second or third kid can be extremely interested in buying a larger house, so that should be the focus of your message. Singles with proper jobs and high income can take comfort and prestige into account — make it the bottom line.

Find out what interests your potential customers before you start crafting your direct mail campaign. That will make your messages more relevant and engaging. Many mailing list companies offer lists with lots of intel on your future recipients, some of which are:

- Estimated household income

- The age of a recipient

- The number of children and their age

- Birth month

- The unit type

- The length of residency

For example, you can create a unique list of families with an elder child who starts school and a newborn baby, who live in a two-bedroom apartment and have an income large enough to qualify for a mortgage.

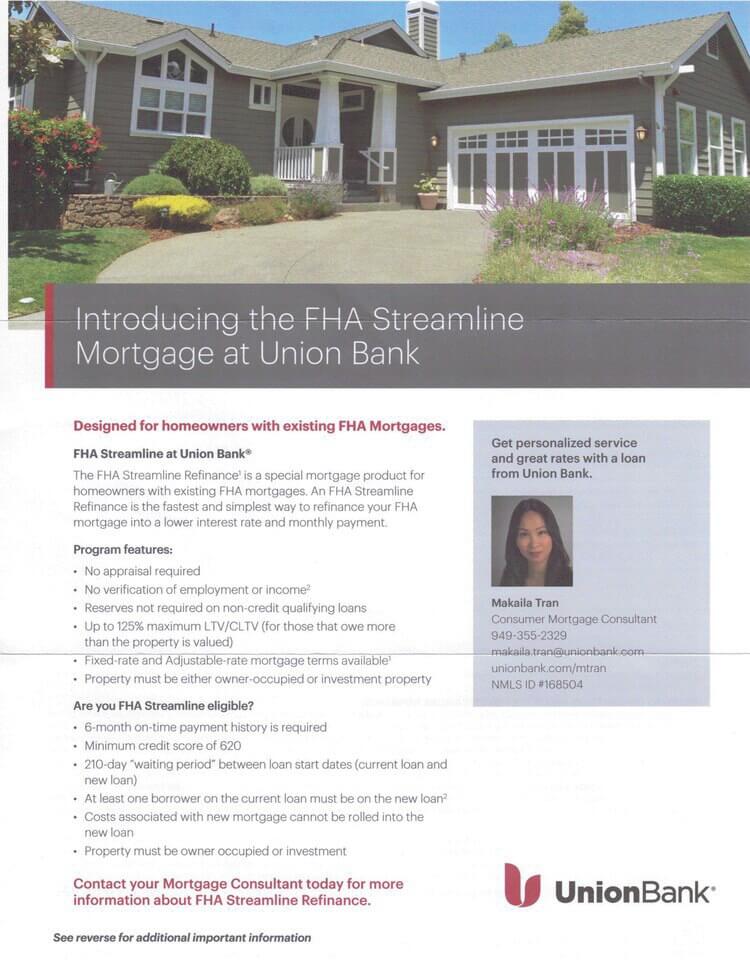

Decide on the content

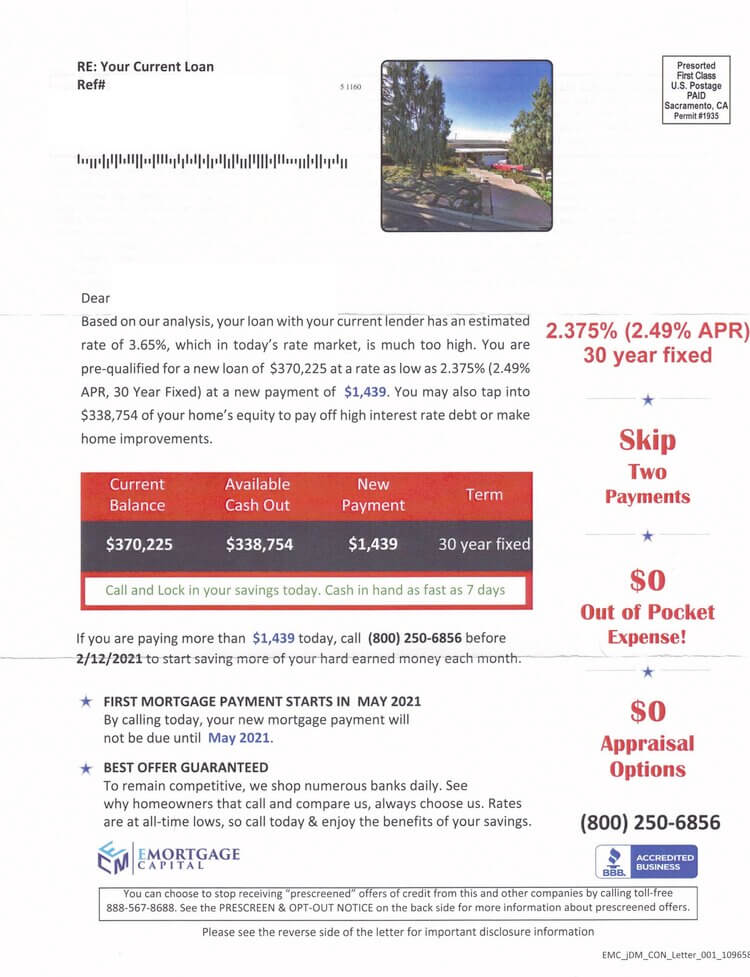

When you have certainty about your goals and the target audience, it’s time to decide on the content and type of direct mail piece. If you’re going for a presentation of housing, you will need high-quality pictures and the property description. If it is some kind of educational material on mortgage rules, you need a clear and detailed guide on the topic. If you are presenting your services as an agent, you’ll need customer reviews and a nice picture of you.

Here’s an example of an agent’s self-presentation. It only has a customer review, but it covers it all. It works much better than a long list of achievements and a boring professional biography.